Compensating balances are less common for personal accounts compared to business accounts. However, some banks may impose minimum balance requirements or offer preferential terms for certain services based on maintaining a minimum balance. These costs, influenced by interest rates and regulations, can impact compensating balance requirements. Banks might seek to offset funding costs by requiring higher compensating balances when funding costs are high. On the other hand, the minimum fixed balance arrangement necessitates that the borrower maintain a set minimum balance with the lender. Unlike the average balance arrangement, which focuses on averages over a period, this method demands a constant balance threshold be met continuously.

- They frequently appear in lines of credit, offering borrowers flexibility while protecting the lender.

- However, if a customer fails to maintain the required balance and incurs penalties or fees, it could indirectly impact their finances and creditworthiness.

- Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

- The practical suggestions in this pamphlet are based upon New York laws,rules and court decisions.

Why Are Borrowers Willing To Accept Compensating Balances?

The compensating balance cuts down on the risk to the lender by allowing for recovery of part of the loan in cases of default. When you retire, your contributions go into the New York State Common Retirement Fund. compensating balance loans The Fund is the pool of money that is invested and used to pay retirement benefits for you and other NYSLRS members. Most NYSLRS members contribute a percentage of their earnings to the Retirement System.

thoughts on “Your Contributions to NYSLRS”

This guarantees that everything we publish is objective, accurate, and trustworthy. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. The store incurs an interest expense at a 6% annual rate on the $40,000, and the owner continues to borrow from the LOC at the beginning of each month to purchase inventory.

Is there a materiality threshold for restricted cash?

Both methods of calculating compensating balances have their advantages and disadvantages. The choice between these methods depends on the preferences and financial circumstances of the borrower and the terms offered by the lender. When a company enters into a loan agreement that includes a compensating balance requirement, it agrees to maintain a minimum balance in its deposit account.

Reason 5: Mitigating Default Risk for High-Risk Borrowers

But if your contributions don’t determine your pension, what difference does it make what the balance is? For one thing, your contribution balance helps determine the amount you can borrow if you decide to take a loan from NYSLRS. Also, you may be able to withdraw your contributions, with interest, if you leave the public workforce before retirement age. A common example involves the down payment in the purchase and sale of aresidence, condominium or cooperative. The contract frequently requires thatthe buyer’s down payment be paid to the seller’s lawyer, in escrow, or to areal estate broker, pending the title closing.

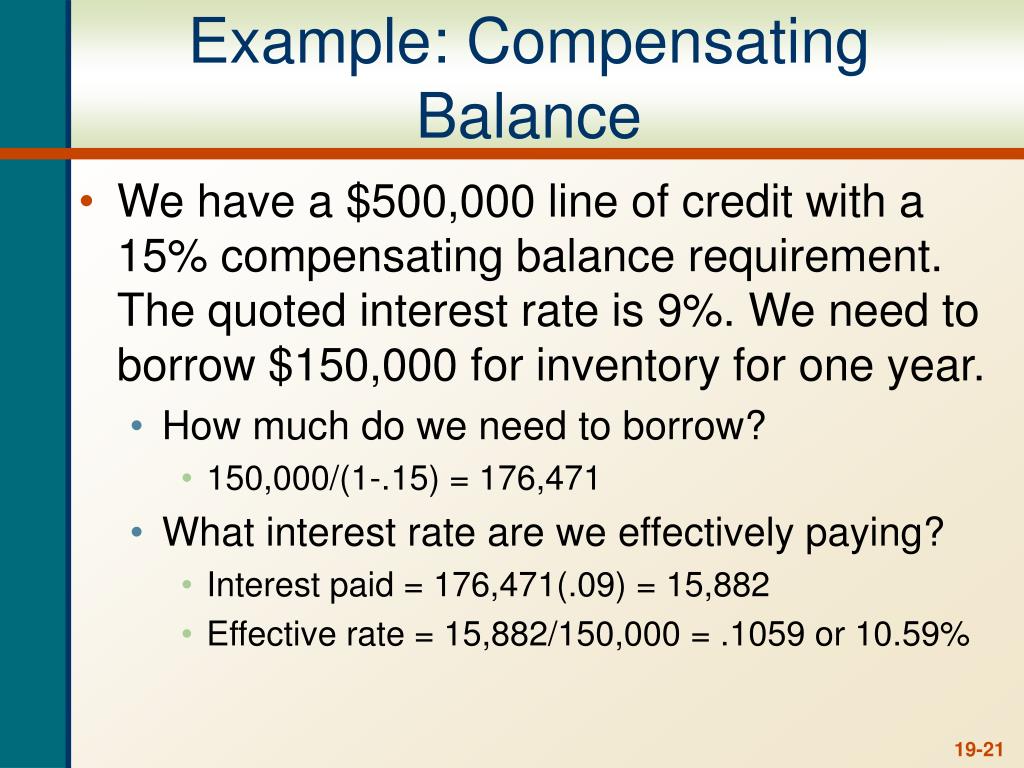

Companies can further enhance clarity by specifying the purpose of this restricted cash, either directly on the balance sheet or through footnotes. The underwriter requires a 5% compensating balance, meaning the city must deposit $500,000 with them until the bonds are sold. This ensures the underwriter has funds available to purchase the bonds if needed. This customization allows borrowers to tailor the arrangement to their specific needs and cash flow patterns, minimizing the impact on their liquidity and maximizing the benefits.

For instance, a lender might require a borrower to always maintain a minimum balance of $15,000 in their account. A compensating balance is a specific amount of money that a borrower is required to keep in a bank account as part of a loan agreement. By holding this balance, the lender ensures that they have some funds on hand if the borrower faces difficulties in repaying the loan. This balance is not just a formality—it serves as collateral, giving the lender more confidence in the loan’s security.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. For example, suppose that Sample Company has two separate loans of $1,000,000 bearing interest at 12 percent. Specifically, the depositor must leave a stated amount on deposit in an account (either checking or savings). A major restriction may be placed on cash by a bank in connection with a loan or a commitment to a loan (known as a line of credit). There may be informal restricted cash arising from management’s intention of using a certain amount of cash for a particular purpose. It works the same way if you wanted to take out an instalment loan for the same amount.

Whether you embrace or avoid compensating balances, you can now do so confidently. You’ll be able to weigh the advantages and disadvantages, negotiate terms effectively, and ultimately make informed decisions that align with your financial goals. We’ve covered a lot of ground, from the mechanics of compensating balances to their impact on your bottom line. Now, you comprehensively understand this financial tool and the factors that influence its size and application. Remember, knowledge is power, especially when it comes to your finances.

A compensating balance is a certain balance that you need to keep to qualify for instalment loans or a line of credit. Basically, it’s a balance agreement that acts as collateral for the lender which helps avoid insufficient balances. If a customer fails to maintain the required compensating balance, they may be subject to penalties or fees, and the bank may restrict access to certain services or even close the account.

As a result, having a compensating balance might make the company’s financial situation look better on paper than it actually is, potentially impacting its liquidity ratios and financial flexibility. The funds are generally held in a deposit account such as a checking or savings account, a certificate of deposit (CD), or another holding account. The borrower who agrees to hold a compensating balance promises the lender to maintain a minimum balance in an account. The bank is free to use the compensating balance in loans made to other borrowers. Businesses with strong credit histories or individuals with significant savings might find alternative loan options with more favorable terms.

0条评论